Power Sector in India

|

Introduction

Power is one of the most critical components of infrastructure crucial for the economic growth and welfare of nations. The existence and development of adequate infrastructure is essential for sustained growth of the Indian economy.

India’s power sector is one of the most diversified in the world. Sources of power generation range from conventional sources such as coal, lignite, natural gas, oil, hydro and nuclear power to viable non-conventional sources such as wind, solar, and agricultural and domestic waste. Electricity demand in the country has increased rapidly and is expected to rise further in the years to come. In order to meet the increasing demand for electricity in the country, massive addition to the installed generating capacity is required.

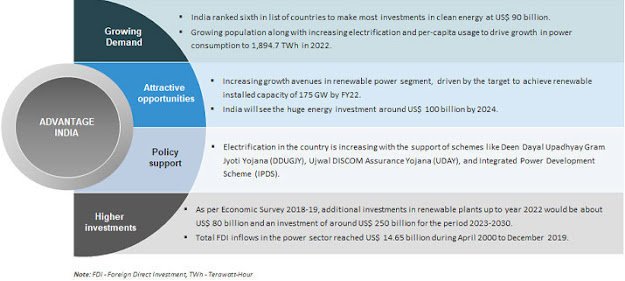

In May 2018, India ranked fourth in the Asia Pacific region out of 25 nations on an index that measures their overall power. India is ranked fourth in wind power, fifth in solar power and fifth in renewable power installed capacity as of 2018. India ranked sixth in list of countries to make most investments in clean energy with US$ 90 billion.

Market Size

Indian power sector is undergoing a significant change that has redefined the industry outlook. Sustained economic growth continues to drive electricity demand in India. The Government of India’s focus on attaining ‘Power for all’ has accelerated capacity addition in the country. At the same time, the competitive intensity is increasing at both the market and supply sides (fuel, logistics, finances, and manpower).

Wind energy is estimated to contribute 60 GW, followed by solar power at 100 GW by 2022 and 15GW from biomass and hydropower. The target for renewable energy has been increased to 175 GW by 2022.

Total installed capacity of power stations in India stood at 368.68 Gigawatt (GW) as of January 2020. Electricity production reached 1,050.78 BU in FY20 (up to January 2020).

Investment Scenario

Between April 2000 and December 2019, the industry attracted US$ 14.65 billion in Foreign Direct Investment (FDI), accounting for three per cent of total FDI inflows in India.

Some major investments and developments in the Indian power sector are as follows:

- In March 2020, the central government signed virtual agreement to conclude strategic sales in Kamarajar Port Ltd, THDC India Ltd and North Eastern Electric Power Corporation Limited (NEEPCO) for which it will receive Rs 13,500 crore (US$ 1.93 billion) from the three deals.

- In December 2019, NTPC announced investment of Rs 50,000 crore (US$ 7.26 billion) to add 10GW solar energy capacity by 2022.

- In August 2019, Sembcorp Industries, the Singapore-based energy made an equity infusion of Rs 521 crore (US$ 101.6 million) into Sembcorp Energy India Ltd.

- Brookfield to invest US$ 800 million in ReNew Power.

- In September 2019, Adani Transmission planned to acquire the entire stake in Bikaner Khetri Transmission.

- ReNew Power and Shapoorji Pallonji will invest nearly Rs 750 crore (US$ 0.11 billion) in a 150 megawatt (mw) floating solar power project in Uttar Pradesh.

- The Government of India is expected to offer nearly 20 power transmission projects worth Rs 16,000 crore (US$ 2.22 billion) for bidding in 2019.

- In November 2018, Renascent Power Ventures Pte Ltd acquired 75.01 per cent stake in Prayagraj Power Generation Company Limited (PPGCL) for US$ 854.94 million.

Government Initiatives

The Government of India has identified power sector as a key sector of focus so as to promote sustained industrial growth. Some initiatives by the Government of India to boost the Indian power sector:

- The Union Budget 2020-21 has allocated Rs 15,875 crore (US$ 2.27 billion) to Ministry of Power and Rs 5,500 crore (US$ 786.95 million) towards the Deen Dayal Upadhyay Gram Jyoti Yojana (DDUGJY).

- Government plans to establish renewable energy capacity of 500 GW by 2030.

- The Pradhan Mantri Sahaj Bijli Har Ghar Yojana- Saubhagya, launched by the Government of India with the aim of achieving universal household electrification by March 2019.

- As of September 2018, a draft amendment to Electricity Act, 2003 has been introduced. It discusses separation of content & carriage, direct benefit transfer of subsidy, 24*7 Power supply is an obligation, penalisation on violation of PPA, setting up Smart Meter and Prepaid Meters along with regulations related to the same.

- Ujwal Discoms Assurance Yojana (UDAY) was launched by the Government of India to encourage operational and financial turnaround of State-owned Power Distribution Companies (DISCOMS), with an aim to reduce Aggregate Technical & Commercial (AT&C) losses to 15 per cent by FY19.

- As of August 2018, the Ministry of New and Renewable Energy set solar power tariff caps at Rs 2.50 (US$ 0.04) and Rs 2.68 (US$ 0.04) unit for developers using domestic and imported solar cells and modules, respectively.

- The Government of India approved National Policy on Biofuels – 2018, the expected benefits of this policy are health benefits, cleaner environment, employment generation, reduced import dependency, boost to infrastructural investment in rural areas and additional income to farmers.

Achievements

Following are the achievements of the government in the past four years:

- India’s rank jumped to 24 in 2018 from 137 in 2014 on World Bank’s Ease of doing business - "Getting Electricity" ranking.

- Energy deficit reduced to 0.7 per cent in FY18 from 4.2 per cent in FY14.

- Over 353 million LED bulbs were distributed to consumers in India by Energy Efficiency Services Limited (EESL) under Unnati Jyoti by Affordable LEDs for All (UJALA) as on July 08, 2019 and 11.17 million LED bulbs were sold by private players till March 2019.

- As of April 28, 2018, 100 per cent village electrification achieved under Deen Dayal Upadhyaya Gram Jyoti Yojana (DDUGJY).